Add an author

Introduce

If you and your partner have recently solidified your commitment to each other, whether you’re buying a house together, planning a wedding, or expecting your first child, congratulations! This is an exciting time. But now comes the big question: Should you consolidate your finances? 💑

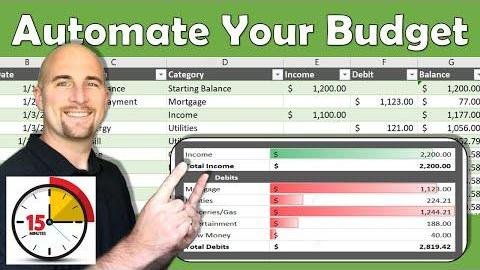

In this article, YNAB (You Need a Budget) walks you through three different budgeting methods with a partner using the YNAB app. They provide in-depth coverage of each method in a light-hearted and upbeat tone, and help you decide how to most safely and efficiently manage your finances together.

Method 1: Fully consolidate financials

If you and your partner want to completely merge your finances without changing bank loyalties, YNAB can provide a reliable and foolproof way to achieve this. Here’s how it works:

- Get involved in everything: Decide to pool all the money you make into a common “pot.”

- Fund pool: Use a shared bank account (can be any bank) to supplement your budget. You can have a checking account in Finland, a savings account in Sweden, a small credit union account in Saskatchewan or Nebraska—it doesn’t matter as long as you have a shared budget.

- Choose your adventure: YNAB allows you to truly “choose your adventure” when creating a budget with your partner.

Advantage:

– Simplify communication and decisions about money.

– Create a shared budgeting experience.

– Provides clarity and transparency.

Method 2: Split mostly with YNAB

If you and your partner want to keep your finances separate but still want to share certain expenses outside of your budget, YNAB offers another way. Here’s how it works:

- YNAB Together: Use the YNAB Together feature in the YNAB app, which allows you to share your YNAB subscription with up to five loved ones at no additional cost. This is ideal for partners who want to manage their own finances but still understand each other’s budgets.

Advantage:

– Maintain separate bank accounts and budgets.

– Provides control and privacy over personal finances.

– Makes it easy for you to collaborate and share expenses.

Method 3: Hybrid approach: shared budget and personal budget

If you’re looking for a hybrid approach that combines shared and personal budgets, YNAB has a solution for that too. Key to this approach is open communication and transparency of shared costs. Here’s how it works:

- Joint bank account: Open a joint bank account together.

- Personal Budget: Each partner manages their own personal budget and links their personal bank accounts.

- Shared Budget: Create a third shared budget and link it to a shared bank account. This budget covers common expenses like rent, utilities, groceries, and pet expenses.

- Personal Spending Categories: Create category groups for personal spending in each partner’s personal budget.

- Shared expense categories: Create shared expense category groups within a shared budget.

Advantage:

– Achieving personal financial autonomy within a common framework.

– Provides visibility into shared expenses.

– Shared expenses can be easily tracked without constant shifting between budgets.

Ultimately, the approach you choose will depend on your values and comfort level with financial transparency and shared decision-making. YNAB believes that communicating around money and creating a safe space for conversation is key to mutual financial success.

In summary, whether you choose to fully consolidate your finances, maintain most separate accounts on YNAB Together, or take a hybrid approach, YNAB can support you on your financial journey with your partners. Remember: the most important thing is that you agree and work together to achieve a common goal. 💪💵

Disclaimer: The video content displayed above was created and is the property of YNAB. We do not claim any rights to this content and are not in any way endorsing or affiliated with the creators. This video is embedded here for informational/entertainment purposes only. The accompanying articles, although sometimes narrated in the first person, are independently written by our editorial team and do not necessarily reflect the views or expressions of the video creators.